While smartphone usage time has increased over the years, that trend has been accelerated by the impact of COVID-19. According to Digital 2020 Global Report (Q3 Update) released by Wearesocial and Hootsuite, 70% of people over the world said they spend more time on their smartphones now than before the pandemic of COVID-19.

This means that online media progressively need to devise to monetize on smartphones.

Meanwhile, promotion on smartphones has become even more significant for advertisers.

FreakOut, an ad technology company which developed the first DSP in Japan in 2011, has been offering smartphone-focused advertising platform in Asia since 2015.

In this article, Senior Vice President of FreakOut, Ken Yamane who leads our global business shares about the current situation and the future prospects of smartphone advertising platform.

Contents

- 1 Why is FreakOut offering a native advertising platform for smartphones in Asia, although in Japan (where the company was founded), the DSP business is the main focus?

- 2 I see. So, is it now Normal (not New Normal)?

- 3 Middle-of-the-road..what exactly does that mean?

- 4 Okay, so that’s how the ad network was born.

- 5 The development of DSP/SSP was based on banner advertisements.

- 6 Does this mean that ad revenue dropped because a higher percentage of traffic came from smartphones and lowered the unit cost?

- 7 Most of the screens are filled with ads, right? Users who visit to consume content (not the advertising), probably get disgusted and leave the site.

- 8 I could understand well the reason why FreakOut launched the native ad platform in Asia at that time. Banner Ad is the ad format in the PC era and Native Ads is the ad format in the smartphone era. But even today, when we look at a smartphone site, we can encounter banner ads, why haven’t they gone away?

- 9 Does this mean that media buying of native ads by using RTB will reduce the number of smartphone banner ads by economic rationale?

- 10 What do you see as the future of FreakOut?

- 11 Other articles on Native Advertising

Why is FreakOut offering a native advertising platform for smartphones in Asia, although in Japan (where the company was founded), the DSP business is the main focus?

In short, native advertising was the New Normal for display ad formats when we first started doing earnest business in Asia in 2015.

I see. So, is it now Normal (not New Normal)?

It hasn’t fully transformed into Normal yet. In other words, I can say that it’s still middle-of-the-road.

Middle-of-the-road..what exactly does that mean?

Well, it might be easier to understand if we start from the history of display advertising. Let’s briefly look back at the history of advertising on desktop.

1994

Just in case you all didn’t know, but this is actually the world’s first display ad (banner ad).

It was advertised on Hotwired, one of the websites in the US.

Hotwired was an online magazine operated as part of Wired Magazine which you might still recognize today.

In the early days of internet advertising, a mainstream method of media buying termed “Reservation Ad” was practiced, whereby advertisers buy ad space of specific media and pay for it according to the period or the number of Impressions.

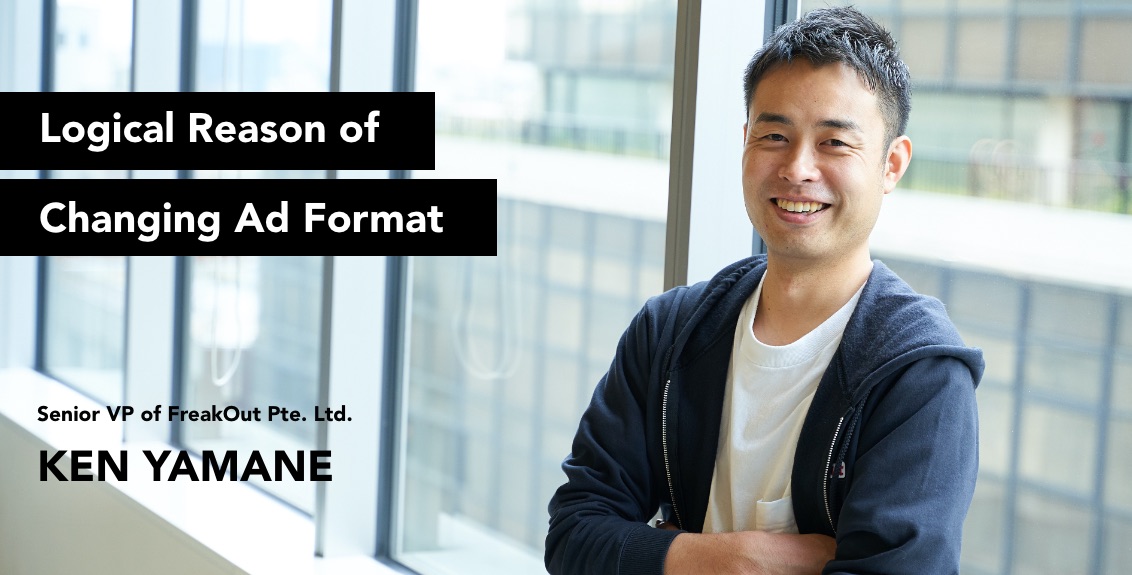

Since then, numerous websites have been published, and search engines have emerged. In that situation, the difference between the sites visited by many users and those not has become apparent.

As a result, the media which gained more user traffic could get enough advertising income, but on the other hand, the media with small traffic struggled with monetization.

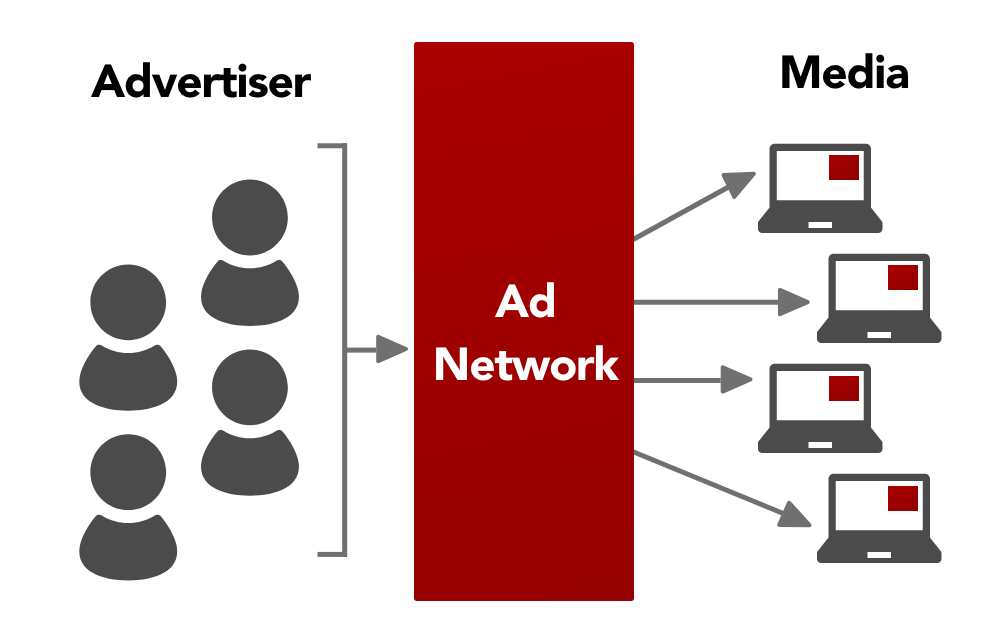

That’s where ad network came in. Ad network companies buy unsold ad inventory and classified them by media category, etc., to sell it in bulk to advertisers.

While ad networks are less expensive than reservation ads, it satisfies the needs of both advertisers who want to maximize their reach in a particular category and media who want to sell their ad inventory.

Okay, so that’s how the ad network was born.

Yes, ad networks were the first players in this ecosystem to take on the role of intermediary players between media and advertisers. A variety of ad networks emerged, making it easier for smaller media outlets to monetize.

Moreover, ad exchanges emerged as a way to balance the supply and demand across ad networks. Media buying through ad exchanges was carried out like “future contracts” which determined the future value (= price) of advertising inventory in advance.

2008

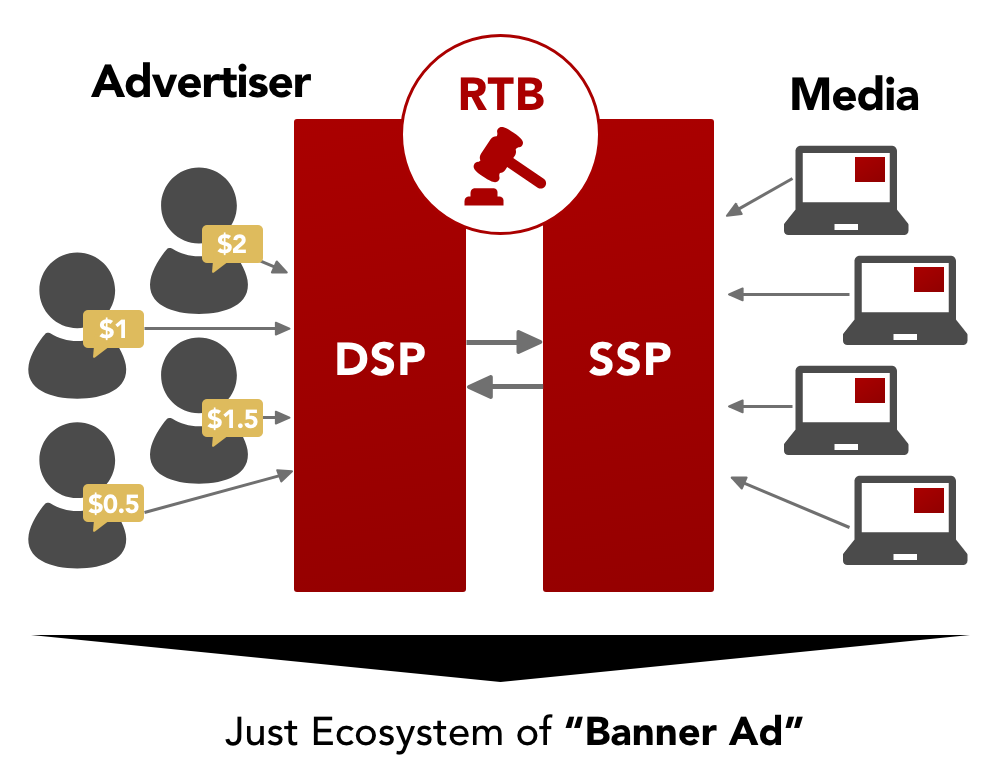

During the 2008 financial crisis, the engineers specialising in financial engineering lost their jobs, and jumped to the advertising industry. Subsequently, Real Time Bidding (RTB) was invented.

Real time bidding is a technology that enables publishers to sell ad space to the advertiser who pays the highest cost for 1 impression during a real time auction. As a platform with RTB technology, SSP (Supply Side Platform) for publishers and DSP (Demand Side Platform) for advertisers appeared at the same time.

After a while, the DMP (Data Management Platform) emerged, and it provided the data that DSP will use as a basis for pricing when buying ads. For example, it makes sense for real-estate advertisers to pay higher advertising costs for rich people who might buy a condominium. Because advertisers can expect higher ROI, at the same time the publishers can sell the inventory with higher price.

This is how SSP and DSP were born. In 2010, FreakOut were one of the first key players in this arena in Japan. Then, many ad technology players appeared and the industry grew quickly in the 2010s.

One of the reasons for this rapid pace of growth is that most of the advertising inventory’s format was “Banner Ad”.

Banner ad itself has a long history since the “Ad Network Era”. The standard size of banner ads is strictly defined and RTB followed that regulation as well. So, when online media adopted the RTB system, they didn’t have to change their ad format and media layout.

Exactly. After that, the Game Changer made the appearance.

2007

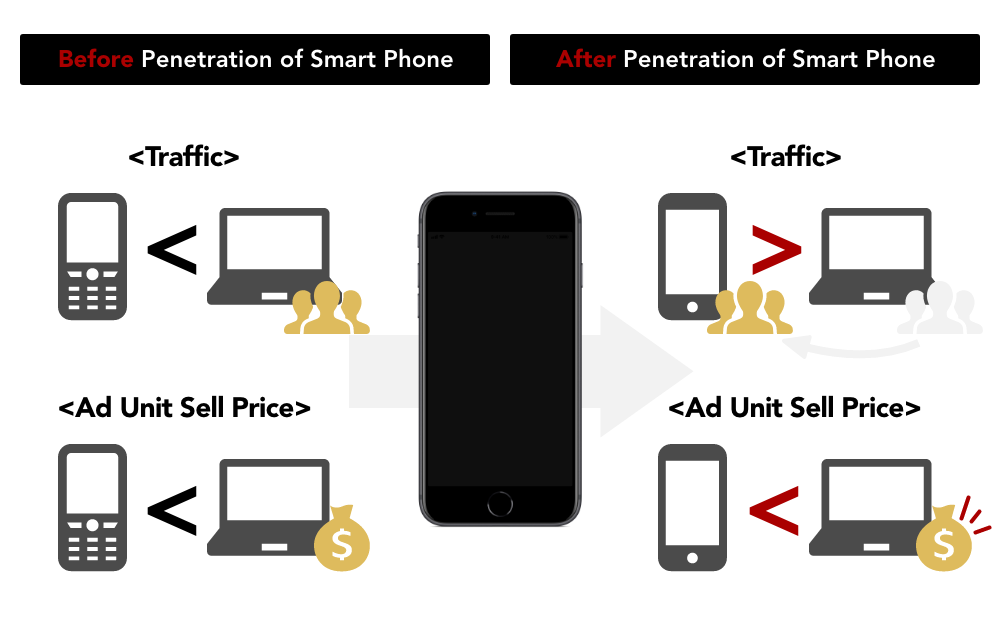

With the release of the iPhone by Apple Inc., smartphone usage began to spread vastly.

The number of users grew explosively, and the internet environment changed from 3G to 4G, so the number of media access from smartphones increased rapidly.

At the same time, media was forced to radically update its media layout.

In terms of monetization, smartphones have smaller screens than PCs, which means smaller advertisements, and because the custom of using smartphones to buy things at the time had not yet been established, the unit cost of advertising on smartphones continued to be lower than on PCs.

Does this mean that ad revenue dropped because a higher percentage of traffic came from smartphones and lowered the unit cost?

Yes, if the media doesn’t take any measures, ad revenue will continue to go down unless the number of users accessing their site itself increases.

So what did the media do?

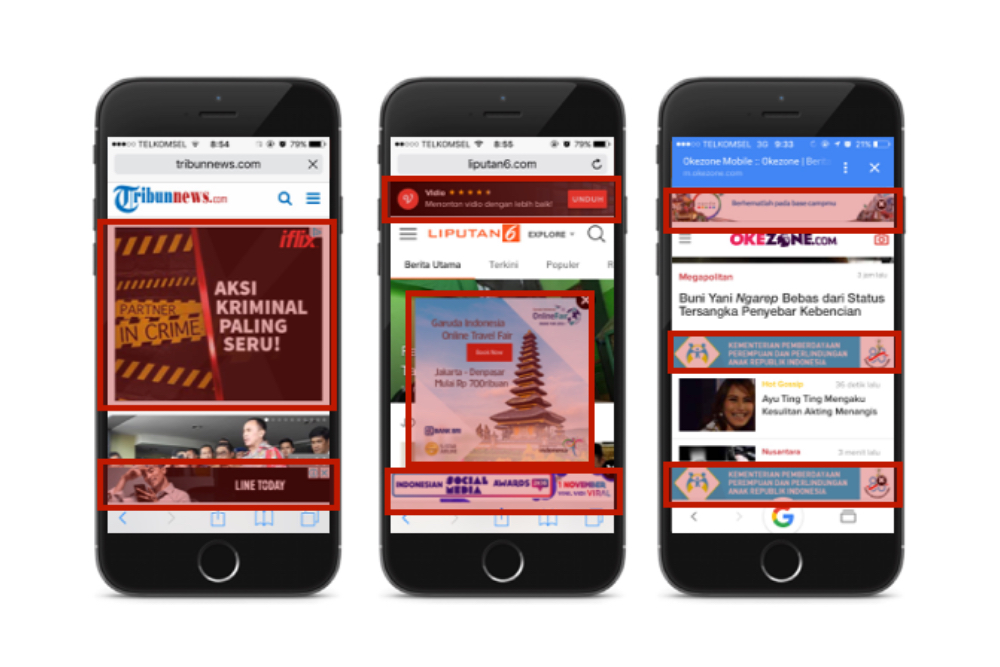

They tried to increase the number of banner ads like the following image and somehow maintained their ad revenue.

Most of the screens are filled with ads, right? Users who visit to consume content (not the advertising), probably get disgusted and leave the site.

Absolutely.

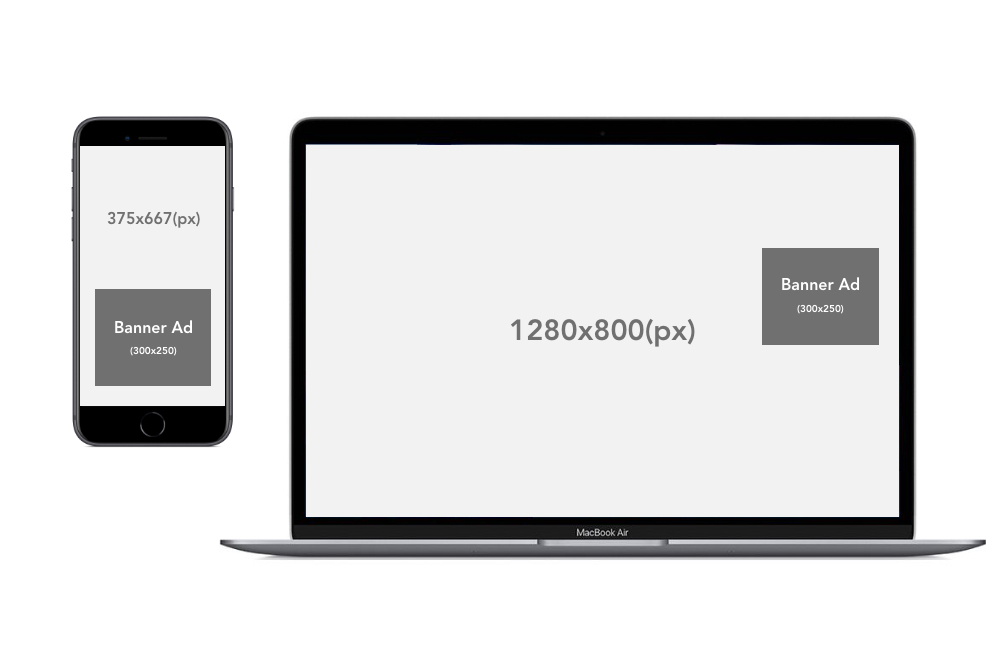

When the typical size, 300×250 rectangular banner is placed on a desktop (1280x800px), it takes up about one-fourteenth of the screen. However, if the same banner is placed on an iPhone 8 (375x667px), the ads will take up about one-third of the screen.

As a result of bringing banner ads which had been developed mainly for PC to smartphone sites, the small screens of smartphones filled with advertising and usability was spoilt. As a result, people left the site and media companies struggled to monetize.

What happens if media companies lose revenue sources?

The income to create contents will decrease and the quality of the contents will decline. Then, people will leave the site extensively. It brings less media traffic therefore less ad revenue.

Furthermore, they try to manage monetisation with a small amount of traffic, they increase the number of advertising again and accelerate numbers of users leaving.

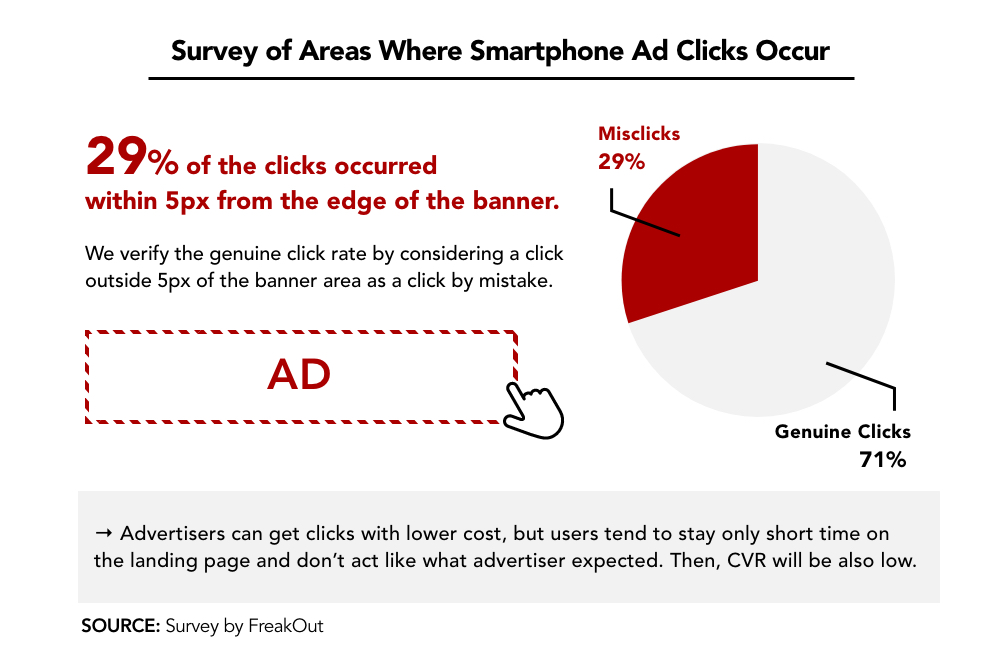

Also, the advertisers who advertise on those media can get damage to their brand image and performance. Because some media implement advertising where users easily misclick to earn more reward from CPC base buyers.

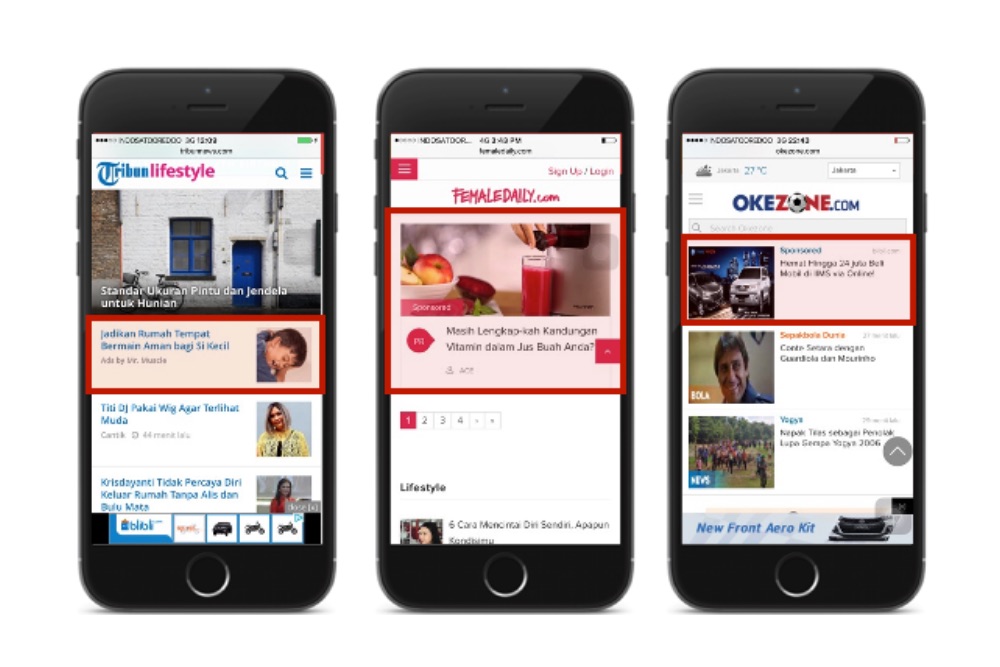

In response to these issues, FreakOut launched FreakOut Native in Asia in 2015 to provide media with a low-stress ad format, fitting the media layout naturally and ensuring media profitability.

In Japan, we launched native ad platform in 2013.

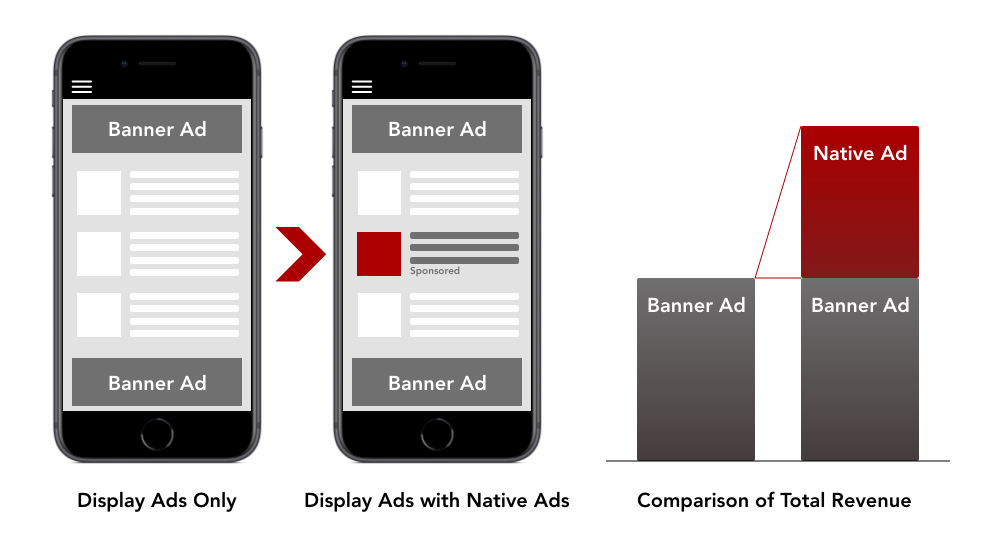

Native Ad gave new revenue sources without spoiling the user experience. Also, it could be implemented without compromising the existing revenue from banner ads.

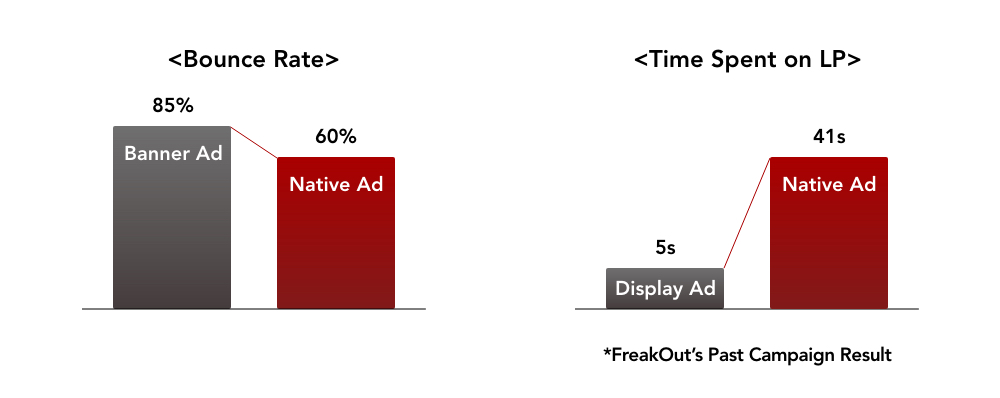

Furthermore, advertisers were able to solve the issues of mobile advertising, the high bounce rate and short time spent on landing page which were caused by misclicks.

That’s an excellent question. That fact is related to what Freakout is doing right now.

It’s because banner ads, although not all of them, still contributed revenue to the media in an economically rational way. As I mentioned earlier, the main ad format in the RTB world is a common banner size that is easy for everyone to participate in the auction. RTBs were able to easily attract auction participants by having many advertisers prepare fixed size banner creatives for routine work. As the number of participants increased, auction pressure created opportunities to sell ad space at a higher unit price.

On the other hand, as I showed the images, the design and layout of native ads differs for each medium. Moreover, the size of the images displayed and the length of the titles and descriptions also differ. For this reason, DSPs and SSPs needed a long time to set up the rules of native ad creative and adapt them to the RTB systems.

Finally, it was around 2019 and 2020 that the world’s largest native advertising players and large DSP players connected via RTB. FreakOut Native was also connected with The TradeDesk in 2019.

[Press Release] FreakOut Native Integrates With The Trade Desk

Yes. However, in industry trends, the use of audience data, which is a major factor in increasing ad unit cost, is expected to disappear in the future due to privacy concerns.

Specifically, with iOS14, Safari browsers will no longer be able to use 3rd party data targeting of IDFA ads by default, and 3rd party data targeting using cookies will no longer be available in Chrome within the next two years.

Banner ads or native ads, which one will perform better at the same media will become an important indicator later on.

As RTB is gradually getting ready for native ads, advertisers will be able to decide which creative format to prepare for DSPs based on the results of their ad campaigns.

However, best practices have been distinctive between banner and native ad creatives in the past campaigns, so I think we need to enlighten advertisers on this point. We would like to talk about this in another article.

What do you see as the future of FreakOut?

Native advertising, which we started offering in Asia five years ago, has not yet gone from New Normal to Normal.

In order to further improve user experience, advertiser ROI, and media ad revenue, we believe there are three things we need to work on. The first is penetration of native ad buying by RTB, the second is a new targeting system which solves privacy concerns, and the third is to develop captivating, richer or more user-friendly ad formats.

With these three points in mind, we will continue to provide the best advertising experience for media, advertisers and users, and lead the Asian smartphone advertising ecosystem in a better direction.

Last but not least, we will be launching a new product soon. Our challenges will continue. Thanks for reading to the end!

If you get interested in Native Ads,

feel free to contact us for more information!