Japan is the third largest game market in the world, after China and the United States. In particular, the online gaming application market is worth 1.3164 trillion Japanese yen (≒12 billion USD) in 2020, an increase of 8.4% over the previous year, and accounts for 2/3 of the whole game market in Japan.

In recent years, not only Japanese domestic but also many overseas gaming apps have entered the Japanese game market thus increasing their market value.

In this article, we will introduce the basic information about the Japanese game market, including its scale, user characteristics, and popular apps, for companies that are planning to enter the market.

Contents

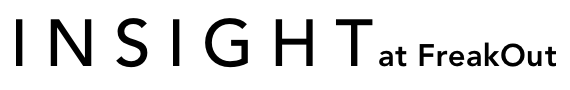

Scale of the Game Market in Japan

According to “Famitsu Game White Paper 2021,” the scale of the game market in Japan in 2020 reached over 2 trillion yen (≒18 billion USD) for the first time eversince this annual survey began. This amount is the total sales of hardware and software, but 2/3 of this amount (= 1.3164 trillion yen) was generated by online gaming applications.

The number of game players in Japan

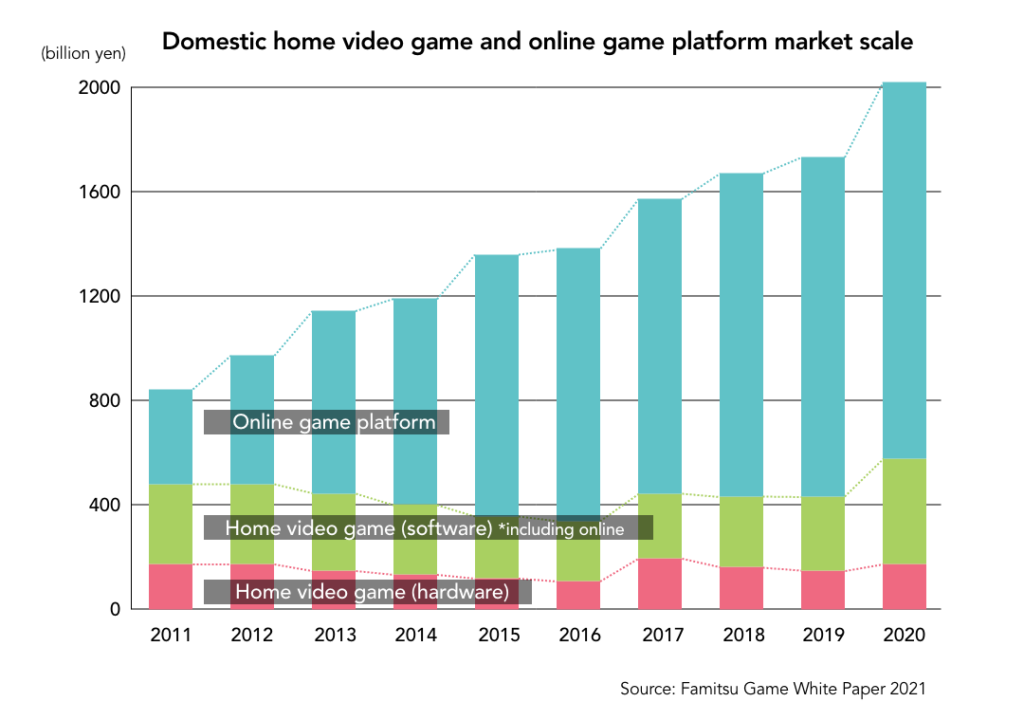

In 2020, the number of game players in Japan reached 52.73 million (total of three categories: home game consoles, PC and smartphone apps), exceeding 50 million for the first time since the survey started in 2015, and the impact of Stay Home by Covid-19 is clearly reflected in the results.

In addition, 75% of these users, which amounts to 39.76 million people, are smartphone gaming application users.

Demographic data of game users in Japan

Next, we are looking at the demographics of Japanese game users. First of all, the ratio of male to female game users in Japan is 51:49, almost the same ratio of males to females. By age, 19% are under 19 years old, 64% are between 20 and 49 years old, and 12% are over 50 years old. These figures correlate with the number of smartphones owned by each age group, indicating the high percentage of smartphone app game users among game users.

Popular Smartphone gaming apps in Japan

Let’s take a look at the top 10 apps by Downloads, Consumer Spend, and Monthly Active Users, based on App Annie’s report.

Top 10 gaming apps by Downloads

As a whole, the rise of casual games is noticeable.Puzzle games such as “Toon Blast” and “Gardenscapes” are ranked high. In addition to that, “Animal Crossing: Pocket Camp”, a very popular title on the Nintendo Switch, ranked second, reflecting the fact that mobile games have become a mainstream gaming device over the past few years. New titles released this year such as “Dragon Quest Tact” and “Disney: Twisted-Wonderland” are also gaining popularity.

On top of that, games categorized as “hyper-casual games” (= games that can be played intuitively), a globally popular genre that recorded 5 billion worldwide downloads in the first half of 2020, are becoming mainstream in Japan. “Push ‘em All” by French game company Voodoo, which ranked 6th, and “Brain Test”, which ranked 7th, were the most downloaded hyper-casual games worldwide in the first half of 2020.

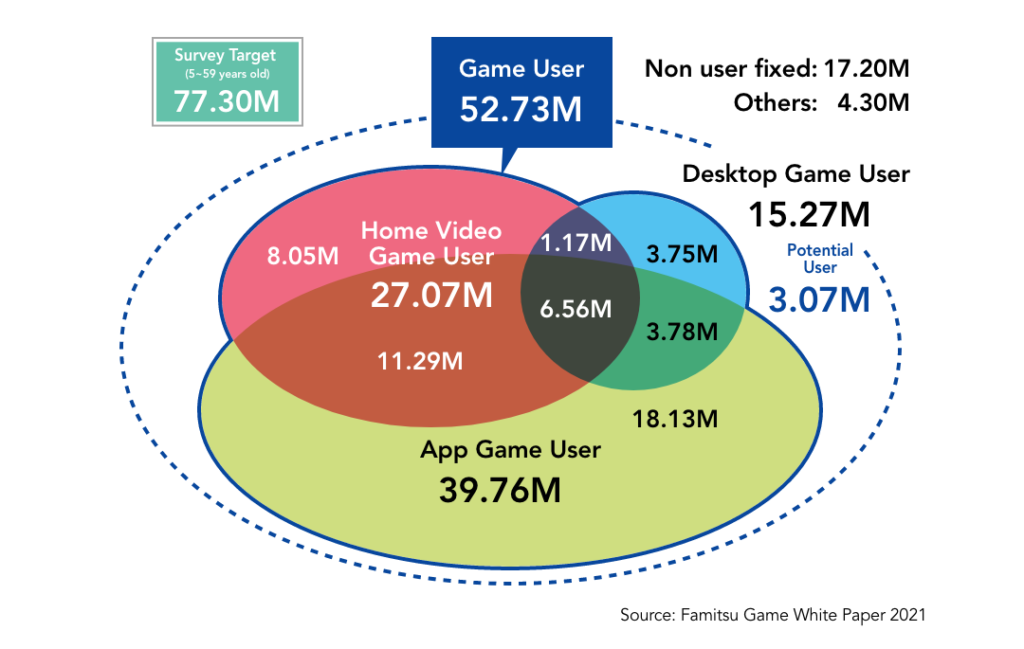

Top 10 gaming app Ranking: Consumer Spending

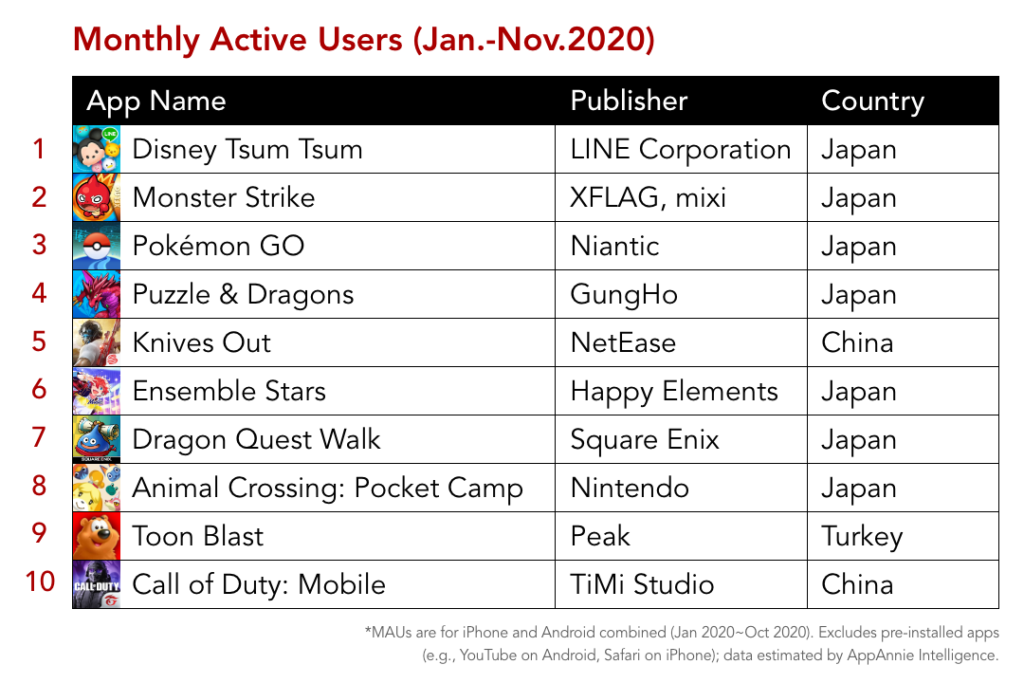

The top 10 gaming apps in the monthly active user ranking

Although the top five apps have not changed significantly from last year, overseas publishers are gaining popularity with apps such as “Knives out” (ranked 5th) and “Call of Duty” (ranked 10th).

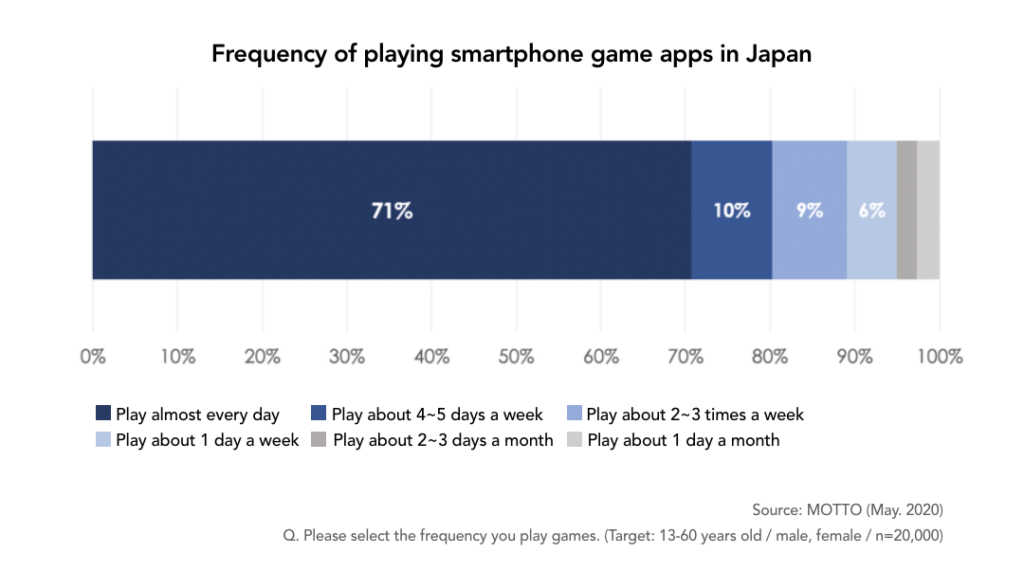

Frequency of playing smartphone gaming apps in Japan

We will take a look at the trends of smartphone game playing in Japan.

First of all, looking at the frequency of smartphone game usage, about 70% of users play smartphone games every day, and about 95% of users play them at least once a week. The frequency smartphone games usage by Japanese is high, even by global standards.

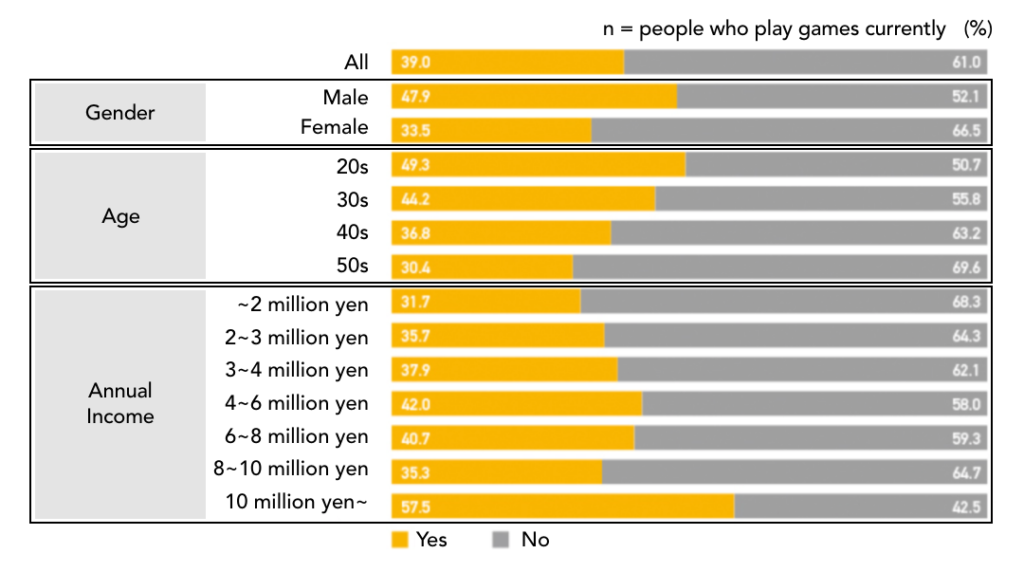

Rate of paying for smartphone gaming apps in Japan

Most of the revenue of smartphone gaming apps is currently generated by users who pay for them. Therefore, paying users are very important for gaming app providers, but how many people do you think actually pay for smartphone games?

According to a survey by Asmarq, 40% of the respondents have paid for smartphone gaming apps in the past year. By gender, males are more likely to pay for smartphone games than females, and the trend is enhanced in younger age groups. At the same time, more than 50% of the respondents with annual personal income of 10 million yen or more, have experienced paying for games. As for the amount, more than half of the paying users paid less than 1,000 yen per month, and about 30% of males and 40% of females paid less than 500 yen.

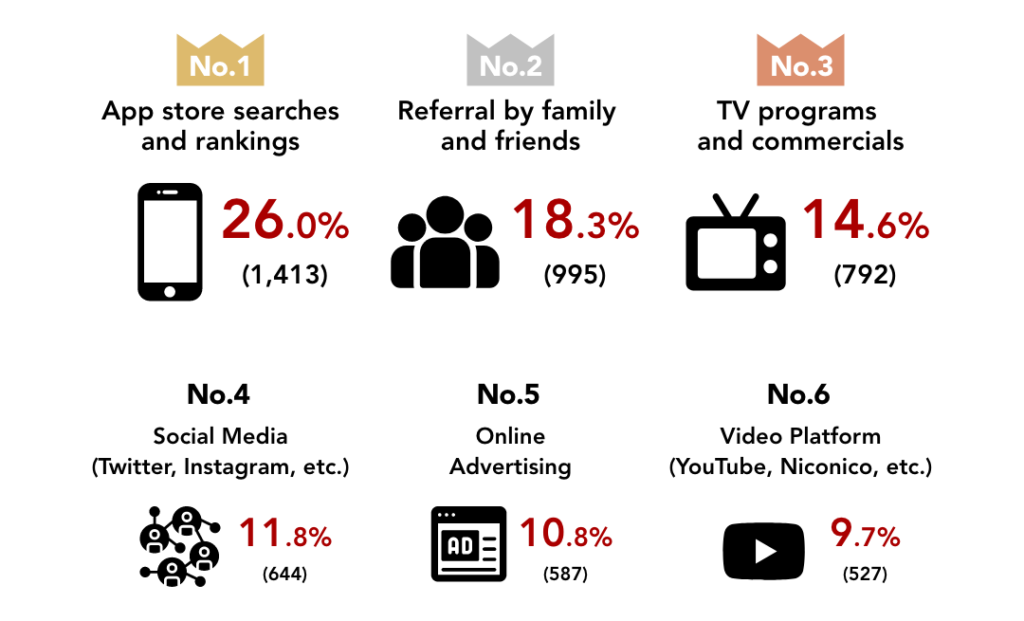

Information sources referenced by gaming app users in Japan

Where do Japanese gaming app users get information related to their apps?

The following chart shows the results of a survey by TesTee Lab on “What made you download a gaming app”.

26% of respondents find gaming apps through app store searches and rankings. Furthermore, 18.3% of the respondents referred to recommendations from their family and friends. What is also unique about the Japanese market is that many gaming apps use TV programs and commercials for their promotion to increase awareness. Of course, social media, online advertising, and online video platforms are also important touchpoints with game users.

Conclusions

In this article, we have reported on the latest situation of the Japanese game market, especially smartphone games. We hope you have found that the Japanese game market is worth considering for entry, and there is something to take away about the characteristics of the market.

In the next article, the FreakOut Cross border marketing division, which has supported a number of overseas gaming apps to enter the Japanese market, will explain app marketing in Japan.

Reference List

- Top 10 Countries/Markets by Game Revenues

- Famitsu Game White Paper 2021 to be Published on July 15, 2020 Global Game Content Market to Grow 30% YoY and Break the 20 Trillion Yen Mark for the First Time in History (Japanese)

- App Annie Announces Consumer Trends for 2020 Looking Back from Apps (Japanese)

- Survey on Paying for Smartphones Games (Japanese)

- The realities of marketing in the smartphone game industry that I want to share with all marketers (Japanese)

- Survey on Game Apps [2020] (Japanese)